Investing in "Tails, Not Heads"

Why taking the flip-side might be a better move

Limited Partners (LPs) often ask us how we plan on "timing the bottom." What they mean by that is if we’re deploying capital, how are we thinking about if and when we’d be best served to invest more to buy at the lowest price. VC is an interesting asset class that allows investors to phase-shift returns out 5-7 years, and the right way of thinking about it isn’t to think about timing the bottom. It’s to think about dollar cost averaging on an extremely consistent basis such that you catch all the bottoms, not just one. High nominal interest rates offer "free lunch" only if you don't buy that there's an inflation premium eroding those nominal returns effectively back toward zero. If there's less interesting alpha in the present, why not play the future?

Venture Capital is effectively phase-shifting. It’s playing the future.

In Q4, Everywhere Ventures closed 38 investments into 35 unique companies, over a 13 week period. This is in a market that’s clearly got some macro headwinds. Our cadence over the last nearly six years has been a check a week. We believe that you don't "time the bottom," you simply back incredible founders every week of the year. You lay down track in sectors pundits haven't opined on yet. When everyone chases GenAI, you look to invest in "Tails, not Heads." Play the other side. You back exceptional founders taking outsize risk, wading into a tough macro with courage.

I recently watched Ben Evans “AI and Everything Else” talk from Slush in Helsinki, Finland, and then I decided it would be interesting to watch his talks from years past to see if he’s been saying the same things, or has been right in years past. Benedict Evans is, obviously an exceptional, lucid thinker, and I’m thankful for his insights and ability to articulate clear trends. But if you watch his 2021 talk immediately after his 2023 talk, it’s striking that even for the most lucid thinkers, it’s never obvious where the world is going. His 2021 talk points at Web3 and the Metaverse as fait accomplis, and included in the “Everything Else” category is a quick reference to some of the semi-conductor chips that were quietly laying groundwork for AI.

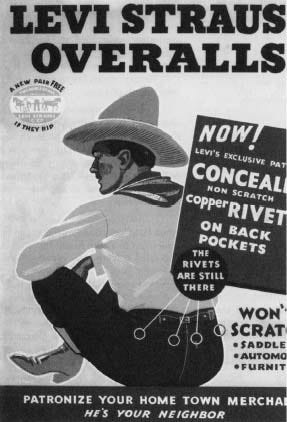

To state the obvious, no one ever knows where we’re heading. So how can founders, and investors, focus their time and efforts to skate where the puck may go? One perspective I often share with founders is what I call “Tails, not Heads.” What I mean by that is how can you see, and play “the other side.” If everyone is running in one direction, how can you provide the counter-balance, the ballast, the structure? Investors often articulate this as “picks and shovels.” What they mean by that is how can you build a product that indispensably parallels a trend. The obvious historical example of this is Levi Strauss inventing a rugged garment called the blue jean, fit with metal rivets to stand up against the harshness of outdoor mining. He observed a trend in the California Gold Rush of 1849, began selling clothes to this demographic in 1853, and pioneered the riveted blue jean in 1873. He invented a category, and did this in the wake of an underlying trend and tailwind he’d personally experienced.

Levi Strauss didn’t go chasing gold, panning in the river. He quietly observed the trends, and created a bespoke category by playing “Tails, not Heads.” He played the other side. He went after “picks and shovels.” He thought independently, but thoughtfully about where the world was going, and he picked his spot.

As a founder, or as an investor, we all have to pick our spots. It’s arguably much harder as a founder because the opportunity cost on your time is infinitely greater, because the level of focus and commitment to build a company is higher. So be thoughtful about macro trends, and see if you can spot tailwinds that might lead to opportunities others have overlooked. For example, let’s talk about SpaceX.

Elon Musk is solving one of the most intractable problems on Earth. Literally “Gravity.” I had the fortune of meeting his co-founder months back, and this was his response to “what problem are you solving.” What he meant by that is Elon’s goal is to reduce the cost per kilogram into space so much that gravity is no longer a cost barrier for most, if not all, companies and organizations. This means that things that happened on Earth, will start happening in space, where there are different regulatory environments, transnational organizations that supersede sovereign limitations. What happened in fiber under our feat will soon happen via spectrum over our heads.

So if you take this trend to be the 1849 California Gold Rush, you can run to the hills of Sacramento and try to build a better rocket, or you can think like Levi Strauss about the dozens of knock-on effects given this new reality already underway. This month we’ve taken three bets in and around this sector looking at legacy hardware replacement, in-orbit data transfer and processing, and cyber security between the tens of thousands of flying edge computers, aka satellites in LEO and VLEO. There are exceptional founders out there now thinking about “Tails, not Heads” in this sector, and in a dozen others like it. For us as investors, we’re looking to find founders with a strong perspective and thesis on their own version of “blue jeans.” What are you selling, what problem are you solving, that’s indispensable in this new world?

We’re actively laying down track. We’re investing in exceptional founders wading into this tough macro climate, excited to take a bet on the future. And we’re not interested in what the pundits say is coming tomorrow. This year it’s GenAI, and next year Benedict Evans talk will highlight something else altogether, and we’ll all nod. So think different, and channel your inner Levi Strauss. Find Tails, not Heads. Listen to the pundits only insofar as you create your own baseline on how to disagree.