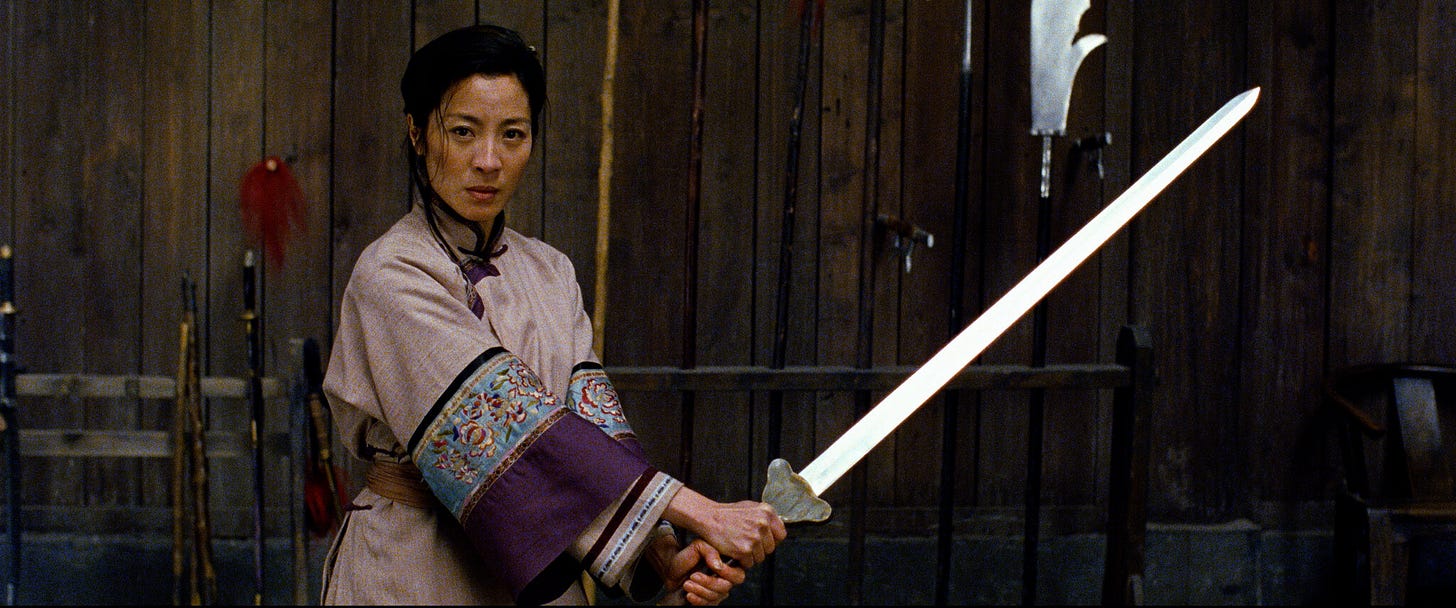

Crouching Tiger, Hidden Terms

Why valuation is no longer the whole story

As markets tighten many look to valuation as the canary in the coal mine. If valuations are still on the downturn then we still have a ways to go until bottom, and if valuations are starting to creep up then perhaps the worst is behind us. Or so it goes.

In actuality there is a structural floor on valuations, as I highlighted in my recent piece “The Goldilocks Valuation Matrix.” As building a company has real fixed costs such as web hosting, technical build costs, etc. and there is a necessary runway to look for product market fit, and absorb sales cycles, the required amount of capital in the pre-seed looks like fixed costs x necessary months of runway = real money. Real money raised is traded for equity in the business, but above a certain threshold of investor equity, compensation for risk taken is the new risk of dilution, or cap table risk. Startups are a multi-year, multi-party game, and so early dilution risk that is too high sets the company up for failure or recapitalization later. In other words, if the necessary pre-seed capital raise is $1M and the maximum acceptable dilution before cap table risk emerges is perhaps 25%, then the structural valuation floor is a $4 million post-money (i.e. a pre-money of $3M + $1M of fresh new cash).

So therefore we might think that the absolute floor on valuations is $4M post money, but this ignores what I call “Crouching Tiger Hidden Terms,” which requires a much closer review of documents that are no longer “plain vanilla.” Investors have gone back to Basin Robbins 31 flavors of ways to get more equity without touching the sacred valuation numbers Y-Combinator, for one, loves to inflate. There are escape valves, and founder equity now slips out in creative new ways. The sticker price on any deal is no longer the sticker price. It’s MSRP with this discount, or that.

For example, we recently evaluated a deal where the valuation was $8M post-money, and all investors were allegedly pari-passu, meaning on “equal foot.” Except for one thing; one investor was getting some common stock for an “advisory” role. Another had a small warrant agreement whereby they were getting bonus shares. So the effective valuation entry for these investors was not in fact $8M post-money because they were, for example, putting in $800,000 for 10% (800K/8M post = 10%) but then they were also getting extra shares as a kicker to their investment. in one case the firm was getting 6% common as an “advisor” and in the other they were getting 2% warrants for some other dubious reason we rolled our eyes at (before we passed).

In other words $800K was equating to 16%, so the effective valuation was not $8M post money, and it was not pari-passu. The effective entry valuation was 800K/0.16 or $5M post money. This was a case of Crouching Tiger Hidden Terms, and while the founder was aware of the ask, they were not aware that their valuation had changed. They continued to speak about the round as though it was an $8M post-money without realizing that their side advisor agreement had lowered their valuation by 37.5% from 8M post down to 5M post. This sneaky ask was a 37.5% discount.

The other ways you might see this expressed will be in interest rates on convertible notes, in how qualified financings are defined to convert SAFEs and Notes, and in the duration before forced conversion to equity. In these conversions we’ll also likely see an increasing complexity around conversion prices, and anti-dilution clauses that aren’t just “weighted-average,” but rather “full ratchets” or more aggressive downside protections. If, for example, a qualified financing (that might now be inflated so as to become less likely) isn’t met within a timeline (that’s shortened), then anti-dilution provisions or more draconian conversions will occur, again usurping more equity.

Things to look out for now include:

Common advisor stock, and investment-adjacent asks

“Studio” investments that come with common stock or warrant kickers

Higher interest rates on Convertible Notes

Shortened-duration conversion windows on SAFEs / Notes

Anti-dilution provisions that aren’t weighted-average

More than 1x liquidation preference

How a “qualified financing” is defined to trigger conversion

And we’re only talking about the land of Narnia that is idyllic early-stage venture capital. If you’re getting out into the tangled woods of Series A and B, terms can be significantly more aggressive as investors seek to manage the concatenation of risks in both survivability and price. At Everywhere Ventures, we’re seeing, in general, 10x revenue multiples hold up, meaning valuations that are roughly 10x trailing twelve-month (TTM) revenue for tech-enabled businesses such as Fintech, Health, and Vertical SaaS. With explosive growth, there might be premium paid on top of that, but for all but A+ teams sitting in San Francisco “doing AI” with three exits under your belt, we’re no longer seeing 20-100x revenue multiples being paid. Forward valuations are now an endangered species, and to paraphrase Marc Andreessen, the bridge loans for credibility in return for future performance just got tighter.

So if you’re sitting at a $100M prior Series A valuation and $6M of revenue, and you’re running low on cash, you have a few options before it’s time to face the music.

Cut burn, extend runway, and consider how to realign 10x revenue to valuation

Shore up your bank account with an inside round on the prior terms

Double down to grow like hell and hope your growth rate justifies the premium

Consider taking in more capital at the down-round, “fair market” price of $60M, knowing that if you wait longer you’ll have to swallow not only a lower valuation, but likely a lot of legal provisions that create additional headwinds

In this new world get out your sword, because you’re going to have to slay dragons, whether you’re a founder or a fellow investor. Beware, plain vanilla is gone, and we’re back at Baskin Robbins where all 31 flavors are out haunting your legal docs. Get your favorite lawyer on speed dial, or give us a call if you need an extra pair of eyes.

If you’d like to learn more about this, tune in 9am PT Wednesday October 4, 2023 with Peter Walker, Carta’s Head of Data Insights, and I in a LinkedIn Live discussion.